Within the invoicing side of At The Yard you have long been able to track payments for your invoices. This means, at a glance, you can always see how much you’re owed and which clients owe it to you!

Today we’re making this tracking more flexible by introducing Prepayments.

Prepayments allows a customer to pay a lump sum upfront and for you to apply this payment to invoices going forwards. There are numerous use cases for this. for example:

Getting started with prepayments is simple, at the top of the admin invoices page there is now a button called Record Prepayment.

Simply click on it to bring up the new Prepayment screen.

(Note: You can also click the dropdown which will allow you to see all existing payments and their status)

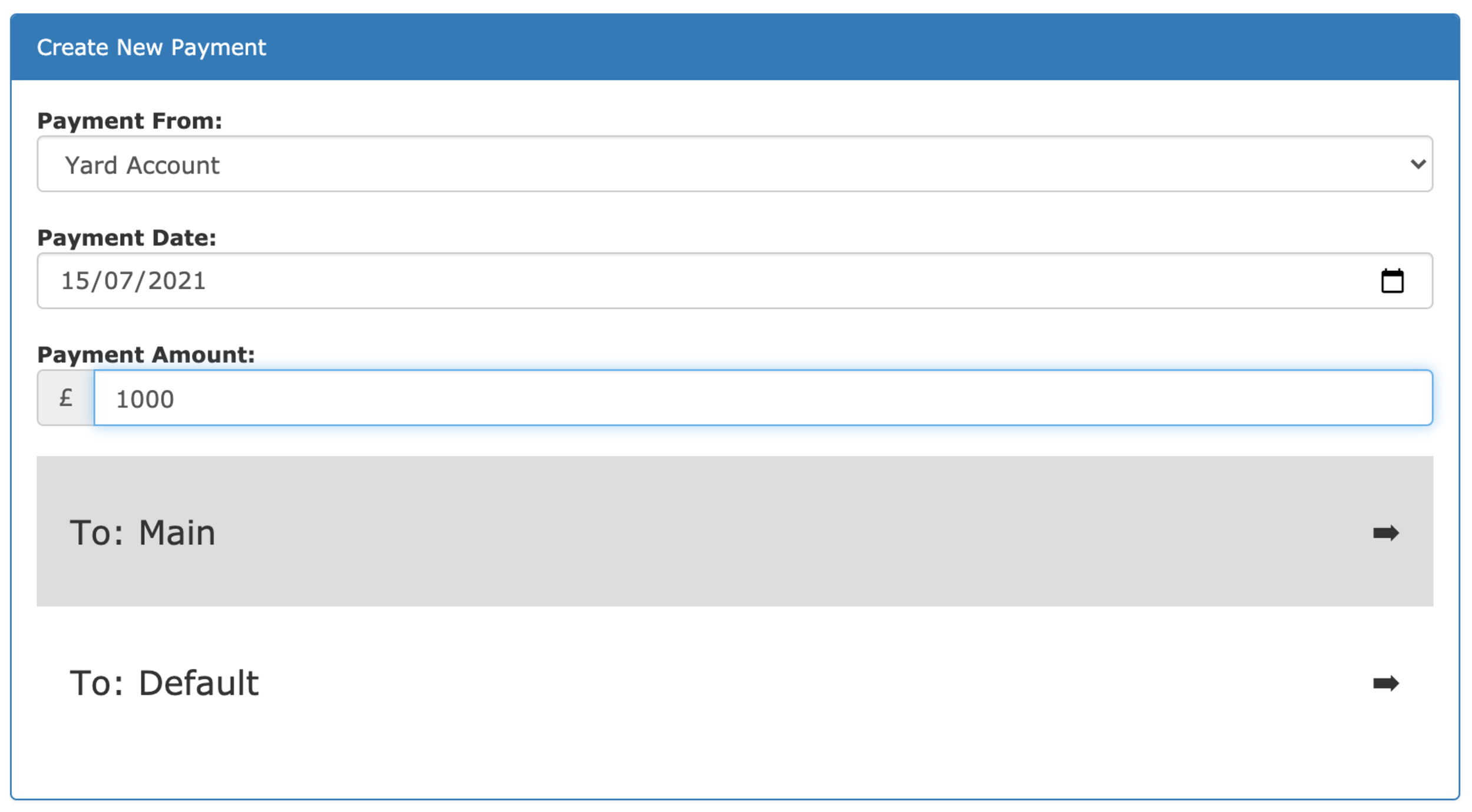

As you’ll see it’s the same as the payment form you’ll be used to seeing when recording payments for invoices. Similarly when recording a payment for an invoice you can record to which account the prepayment was made and by which method it was paid.

That’s all it takes to record the prepayment and have it ready to apply at a later date.

When it comes to invoicing time you simply go to Record Payment on an invoice as usual but now you’ll see a new option to Assign Existing Payment.

From this screen all you need to do is click on Assign To This Invoice and choose how much of the prepayment you want to apply.

As with our entire invoice and payment tracking system we support syncing these payments and allocations to both Xero and Quickbooks, meaning you can keep your accounts as organised as your yard.

Due to our commitment to sync data within At The Yard to various accounting packages there are a few limitations with prepayments at this time. We are, in general, dependant on the integration options provided to us by the 3rd party packages we sync with and so whilst we are looking into working around these limitations we wanted to make you aware of them for now: